Brexit is wasted on the young: UK-based young professionals show interest in moving to mainland Europe

As the negotiations continue to falter and frustrate, how will the flow of young professionals fare in a post-Brexit Europe?

WHILST THERESA MAY'S show-stopping survival of Parliament Idol keeps the meme community alive and kicking, HousingAnywhere wanted to find some method in the madness. By analysing the user trends on the platform, we were surprised to detect a notable link between the political developments dominating the media and the search behaviour of young, UK-based professionals on the platform.

Though Brexit has bored everyone else out of their minds, this topic is pretty hot for us. HousingAnywhere hires young professionals from every corner of the globe, and our platform’s raison d'être is to facilitate the movement of young professionals from city to city, continent to continent, hemisphere to hemisphere. In short, our employees are also our target audience, and so the movement of young professionals abroad ‒ and the housing challenges they subsequently face ‒ really gets us going. Needless to say, the ripple effects of the UK referendum have been unprecedented, and as a company, we are more curious than ever to see what Brexit holds in store for the housing market.

However, the spectacle of the UK’s departure from the European Union woefully conflicts with our mindset; as self-confessed data junkies, speculation, hearsay, feelings and unicorns just don’t suit us. Though we staged a noble resistance, we eventually surrendered to our impulses, and brought forth the indices, axes and calculators. In an attempt to shed what light we can on the Eton Mess situation, we’ve picked apart our platform, crunched the numbers and learned a little more about our UK-based users. We hope you’ll find it as refreshing as we did to sink your teeth into some real, hard data about the hard ‒ …oops, we meant ‘soft’ … no sorry, wait ... ‘chewy’, hmmm ‘brittle’?, ok ok ‒ downright, MUSHY Brexit.

The research

Our devoted data science team analysed the platform’s statistics from the 1st December 2018 to 1st February this month, recording both the number and the behaviour of our users. The team was particularly interested in tracking the behaviour of users hunting for mid to long-term accommodation in Europe and specifically, users with UK IP addresses [1]. The figures revealed that UK usage increased by a whopping 153% alone during these two months. However, during the same time period, we have witnessed a total global increase of 119% searches on the platform.

In order to gain a clearer view of the sole effect of the ‘Brexit period’, we have corrected for the overall increase in use, and subtracted the global search increase from the UK search increase; this presented a 33% total increase of UK searches from 1st December 2018 to 1st February 2019. This correction for the global increase also allows us to account for the general popularity our platform is garnering in the UK ‒ regardless of the current theatrics of the nation’s politics. In essence, what our data science team revealed is that the number of young professionals, based in the UK and looking for accommodation abroad, has shot up significantly in the past two months on HousingAnywhere.

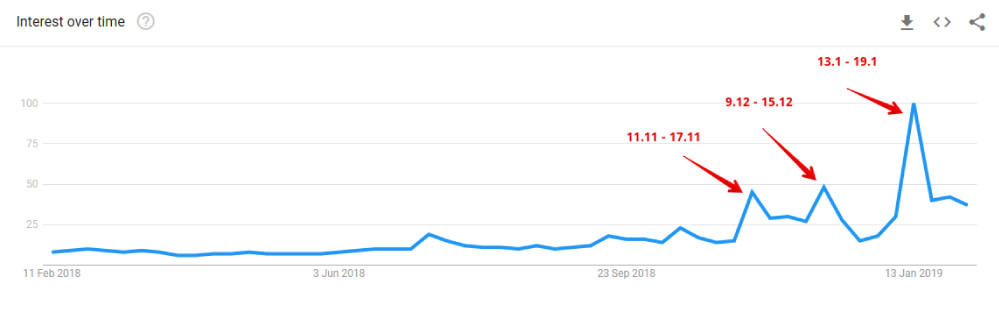

The team was struck however, not only by this surge in UK-based usage, but also by the correlation they unearthed between our UK traffic and the popularity of ‘Brexit’ as a Google search term. It transpires that, as Google searches for ‘’Brexit’’ spiked on 3 occasions over the past 2 months, so too did the traffic of UK users browsing our platform for accommodation in mainland Europe. This total UK usage increase of 33% over the past 9 weeks ‒ a time during which online Brexit-talk distinctly peaked ‒ indicates that the negative discussions around Brexit, coupled with the spiralling political panic, is prompting people to seek accommodation (and supposedly, a life and job to match) abroad.

This Google Trend Chart displays the rate of search interest for the term ‘Brexit’. During the same period, we detected a similar increase in UK users on our platform searching for accommodation in Europe.

So where are these UK searchers based? The overwhelming portion are Londoners; in fact, 45.5% of the Brits logging onto our platform during these 2 months hailed from the capital. Besides London, the second (but markedly lower) percentage of users came from Manchester (2.2%), followed closely by Birmingham (2.0%)[2]. So who exactly are these Londoners considering life abroad? One of our key demographics of course ‒ young, working professionals. Our data revealed that those debating a hop across the channel (individual ‘brexits’) were predominantly between the ages of 25 and 34.

The pursuit of business?

This working demographic is no doubt mindful of the proposed emigration of big companies to European capitals. It is predicted that a third of UK businesses are considering moving because of Brexit, with 250 firms alone approaching the Dutch government for relocation talks. Much of mainstream media tends to focus on the impact of Brexit within the UK’s borders; when businesses up and go, it’s as though they topple into an abyss beyond Dover, never to be heard of again. But as many will testify, there is life and opportunity beyond. Here, somewhere beyond the sea, the HQs stand on golden sands, and clearly, where the relocating businesses go, young professionals consider following.

Where on earth?

With or without the proposed emigration of major and minor UK businesses, Europe offers a hell of a lot for young professionals ‒ beyond the 9 to 5 life that is. To dig deeper into the appeal of city-living, we recently conducted research into the movement of internationals. Typically, European cities perform well for quality of life with a lower cost of living, even if they have fewer available jobs than their American or Asian counterparts.

So which European cities attracted our searchers from London? From our 2019 research, we can reveal that a city that enjoyed a pronounced increase in popularity from young professionals residing the UK was Munich; Bavaria’s capital experienced a staggering 289% increase in interest from Brits on our platform, and lo and behold, the city was established as the best city to live in. With a high quality of life and open-mindedness score (9.8 and 8.7 out of 10 respectively), the startup score for Munich was also the highest possible, suggesting it is an attractive city for long-term relocation.

During our tracking, users from London looking for accommodation in Geneva also rocketed, by a 253% search increase no less. Like Munich, Geneva scored well for quality of life on our Top 100 list. Helsinki was also popular among UK users between December 1st and February 1st; Finland’s capital witnessed a 191% boost. Once again, though the number of available jobs is generally lower than in non-EU cities, the quality of life is significantly high (9.6/10).

P(L)aying the rent

The notoriety of London rent is another factor that is likely to make younger locals think twice about staying. Three months ago, the Metro published data from OnTheMarket.com which gathered the average rental rates of each London borough. The research found that a one bedroom property in Camden will have tenants paying approximately £1,944.28 a month. That’s 61% of the average person’s salary spent on rent every month.

In sharp contrast, according to our European Rent Index, Milan and Barcelona have a significantly cheaper average monthly rent (for a similar one bedroom apartment) at 1,200 EUR. But if you really want some extra cash at the end of the month, Brussels is definitely the place to secure a high-flying job, with inhabitants (on average) paying around only 900 EUR per month for an apartment. Sorry Camden. That being said, if there is an influx of UK professionals to these more affordable European cities, the rental rates won’t stay golden for long.

HousingAnywhere’s CEO, Djordy Seelmann, reflects on what an increase in migrating businesses and workforces could mean for municipalities and real estate stakeholders:

Some European cities have already reported their ongoing talks with UK-based companies looking to relocate their headquarters to Europe. We cannot predict how many young professionals will actually follow through with the platform trend, and act on their search behavior, but I think we can safely conclude that these sought-after cities must prepare for all eventualities, regardless of ongoing political negotiations. We’re seeing rent increase in these cities year upon year; in Berlin, for example, we have witnessed medium rent rise by 4.64% in Q4 2018, compared to the preceding year. I expect, as a result of Brexit, more pressure will fall on these cities and their already strained rental markets.

What next?

Our platform data at HousingAnywhere suggests there may be some interesting possibilities on the horizon for EU property owners. Our advice? If you’re a European property investor or involved in city management ‒ and better still, based in Munich, Geneva or Helsinki ‒ stay alert to all the developments and negotiations. Even if you’re simply beginning to consider your opportunities in European cities, don’t rule out the possibility of a flow of young professionals from the UK. Catch the surf and be prepared.

So, Brexit. A nightmare or a new dawn? Whilst the powers that be continue to puzzle it out (with just 28 days to go), we hope our findings have swept away at least a speck of the speculation.

Written by a young, born-and-bred Brit that staged her own Brexit.

[1] Mind the gap! We are NOT referring to UKIP, the UK Independence Party ‒ staunch Brexiteers and right-wing Eurosceptics ‒ but users with an Internet Protocol address in the UK.

[2] Every other UK city recorded negligible increases, at approximately 1%

[3] Quality of life is a metric based on three variables: 1. Safety - the level of reported crime, as well as a greater sense of citizens’ security, 2. Health - the quality of healthcare and overall satisfaction with medical institutions, 3. Environment - the city’s level of pollution.